Secure Your Future with Specialized Financial

Advisor in Long Beach, CA

Locally Owned & Operated since 1990

Locally Owned & Operated since 1990

Locally Owned & Operated since 1990

Fiduciary Financial Advisor in Long Beach, CA

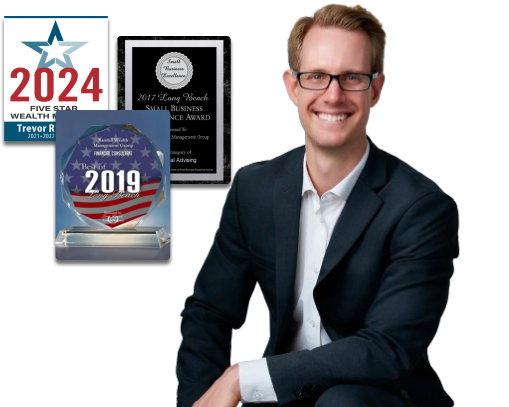

As a Certified Financial Planner® (CFP®) and Retirement Income Certified Professional® (RICP®), I specialize in helping individuals confidently navigate their journey to a secure and fulfilling retirement. My mission is to provide you with personalized strategies, expert insights, and unwavering transparency every step of the way.

Financial Advisor in Long Beach, CA

3780 Kilroy Airport Way Suite 200 Long Beach, CA 90806

Trustindex verifies that the original source of the review is Google. I have complete faith in Trevor Randall. He and his company are looking out for my best interests and I wish him the best because he IS the best in everything he does!Trustindex verifies that the original source of the review is Google. If you’re looking for an investment advisor that’s easily accessible, communicative and feels like family, then this is the place for you! It also helps that Trevor and his team are well versed in investment strategies that are tailored according to each individual’s unique plans and risk tolerance. I am nearing retirement and I would not trust any other firm to guide my plans.Trustindex verifies that the original source of the review is Google. Thank you absolutely the best in the investment community ☝️Trustindex verifies that the original source of the review is Google. I am very happy with Randall Wealth Management! Trevor keeps us informed and answers a lot of stupid questions for us and answers his phone!

*Testimonials appearing herein may not be representative of the experience of other clients and are no guarantee of any future performance or success. No client was paid for their testimonial.

I have a Master's Degree in Personal Financial Planning from Kansas State, providing a solid foundation for addressing complex financial needs.

As President and CEO of Randall Wealth Management Group, I’m committed to long-term client success with 30+ years of trusted service.

Our success is based on your success. Our sole goal is for you to have the best retirement possible and we’ll do our absolute best to help you achieve that.

Every client receives personalized, hands-on attention because your financial future deserves nothing less.

I offer clear, no-surprise fees, including a 1% management fee on select investments, with no fees on cash, money markets, CDs, and T-bills, and no trading costs.

I personally oversee every aspect of your retirement plan, ensuring it aligns with your unique needs and goals.

We meet in person or via Zoom to discuss your financial situation, goals, and investment philosophy.

We use our Retirement Planning Software to analyze key factors like income, retirement age, investments, and expenses.

I evaluate your current investments to ensure they are high-quality, and aligned with your retirement objectives.

We review the personalized retirement plan I designed to meet your unique needs and goals.

As a client, your accounts are closely monitored, with periodic updates and adjustments as needed.

Our financial advisor will analyze all aspects of your financial life and identify actionable strategies to help you achieve your objectives and goals.

Our financial advisor will analyze all aspects of your financial life and identify actionable strategies to help you achieve your objectives and goals.

At Randall Wealth Management Group, we understand that retirement journeys are unique. Our goal is to provide you with financial security and peace of mind. Apart for providing exceptional service to our clientele, we also promote networking, education and additional benefits including:

With us, you’ll receive guidance in retirement planning, investment strategy, and legacy security.

Our team knows all aspects of financial planning, investment management, and retirement strategies. We follow the latest market trends and regulatory changes to provide you with up-to-date advice aligned with your goals.

We understand that each individual has unique financial circumstances and goals, which is why we take the time to listen and understand your needs before crafting personalized solutions. Our client-centric approach means that your satisfaction is our top priority.

Our team is always ready to provide expert advice if you have any questions. We provide 24 hours response time and are ready to help with any concern that you may have.

We prioritize your income growth by offering straightforward compensation, including commissions, hourly fees, and/or a modest 1% management fee applied to stocks, bonds, mutual funds, and ETFs. Importantly, there are no charges on investments such as cash, money markets, CDs, or T-bills. There are also no trading cost fees.

We’re dedicated to actively monitoring and fine-tuning your portfolio throughout the year, ensuring we follow the ever-changing US economy together. Our compensation grows with your accounts, creating a partnership defined by mutual success and aligned interests. Your financial goals are not just a priority; they’re our mission.

I believe in complete transparency when it comes to how I’m compensated. My fees depend on the type of service I provide:

Randall Wealth Management Group Financial Advisor is ideal for individuals and families seeking personalized financial guidance tailored to their needs. Whether you're starting to build wealth or planning for retirement, their expertise offers valuable insights and strategies. If you value comprehensive planning and proactive investment management, they're a great choice.

Our financial advisor determines the best investment strategy for you through a personalized approach. We assess your goals, risk tolerance, and financial situation to develop a tailored plan that aligns with your objectives. Leveraging our expertise, we recommend strategies to optimize returns while managing risk. We regularly review and adjust your plan to ensure it remains aligned with your goals and adapts to changes in your situation or market conditions.

The frequency of meetings with your financial advisor depends on your needs and preferences. Typically, we schedule regular meetings to review your financial plan, assess progress toward your goals, and make any necessary adjustments. However, we can also meet more frequently if there are significant changes in your life or financial situation that require immediate attention. Ultimately, our goal is to ensure you feel supported and informed throughout our partnership.

Our financial advisor stays updated on market trends and regulatory changes through a variety of methods. This includes actively monitoring financial news, attending industry conferences and seminars, participating in professional development programs, and leveraging research from reputable sources. Additionally, we maintain memberships in relevant professional organizations and networks, allowing us to stay connected with other experts in the field and exchange insights. By staying informed and continuously educating ourselves, we ensure that our advice remains current and relevant to your financial needs and goals.

Our financial advisor manages risk for client portfolios through a comprehensive approach. We assess your risk tolerance, goals, and time horizon, diversify assets, and strategically allocate them. Continuous monitoring and periodic rebalancing ensure alignment with your objectives. Stress testing helps assess performance under different scenarios, allowing proactive adjustments to risk management strategies. Our goal is to effectively manage risk while optimizing long-term returns.

As a financial advisor serving Long Beach, California, I assist clients across all local ZIP codes, including:

90745, 90746, 90749, 9075,90801, 90802, 90803, 90804, 90805, 90806, 90807, 90808, 90809, 90810,90813, 90814, 90815, 90822, 90831,90832, 90833, 90834, 90835, 90853

Address: 3780 Kilroy Airport Way Suite 200 Long Beach, CA 90806

Hours of operation:

Monday: 9:00 AM – 5:00 PM

Tuesday: 9:00 AM – 5:00 PM

Wednesday: 9:00 AM – 5:00 PM

Thursday: 9:00 AM – 5:00 PM

Friday: 9:00 AM – 5:00 PM

Saturday: Closed

Sunday: Closed

Long Beach, located along Southern California coastline, has a Mediterranean climate. The mild, sunny weather in Long Beach year-round is perfect for outdoor activities and long walks.

While the cost of living in Long Beach is slightly above the national average, the city's diverse housing options cater to various preferences and budgets, ensuring retirees can find accommodations that suit their needs. From beachfront condos to suburban single-family homes, there's something for everyone in Long Beach's vibrant real estate market.

Moreover, Long Beach provides residents with access to quality healthcare services. Facilities like Long Beach Memorial Medical Center and St. Mary Medical Center offer a wide range of medical specialties and advanced treatment options.

Long Beach offers retirees a high quality of life with its desirable climate, abundant amenities, and vibrant cultural scene. The city's unique blend of natural beauty, recreational opportunities, and community spirit makes it an attractive destination for retirees seeking an enriching and fulfilling retirement lifestyle.

Source: visitlongbeach.com

City of Long Beach Treasury Bureau

+1 562-570-6845

333 W Ocean Blvd # 6, Long Beach, CA 90802, United States

City of Long Beach Financial Management

+1 562-570-6048

411 W Ocean Blvd, Long Beach, CA 90802, United States

Long Beach Chamber of Commerce

(562) 436-1251

1 World Trade Center Suite 101 Long Beach CA 90831

Long Beach Local News

(562) 653-NEWS (6397)

3553 Atlantic Ave. Suite B #1191. Long Beach, CA 90807

Book a Complimentary Consultation

We can help you address your needs of today and for many years to come. We look forward to working with you.

Check the background of your financial professional on FINRA's BrokerCheck.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. Some of this material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named representative, broker - dealer, state - or SEC - registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.

We take protecting your data and privacy very seriously. As of January 1, 2020 the California Consumer Privacy Act (CCPA) suggests the following link as an extra measure to safeguard your data: Do not sell my personal information.

Copyright 2023 FMG Suite.

Randall Wealth Management Group and Vanderbilt Financial Group are separate and unaffiliated entities. Vanderbilt Financial Group is the marketing name for Vanderbilt Securities, LLC and its affiliates. Securities offered through Vanderbilt Securities, LLC. Member FINRA, SIPC. Registered with MSRB. Clearing agent: Fidelity Clearing & Custody Solutions. Advisory Services offered through Consolidated Portfolio Review, a Registered Investment Adviser. Clearing agents: Fidelity Clearing & Custody Solutions, Charles Schwab. Insurance Services offered through Vanderbilt Insurance and other agencies. Supervising Office:125 Froehlich Farm Blvd, Woodbury, NY 11797 • 631-845-5100 For additional information on services, disclosures, fees, and conflicts of interest, please visit www.vanderbiltfg.com/disclosures